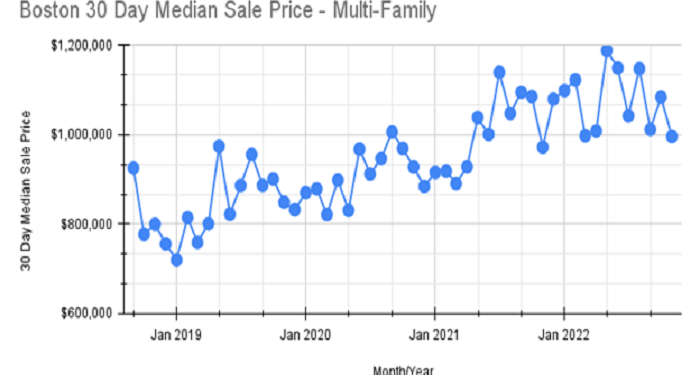

Demand for multi family homes in Boston is eroding based on the most recent MLS data. Total 30 day sales of multi-family properties were down for the fourth month in a row in Boston. This drop in total sales occurred as economic conditions have worsened. Soaring inflation has prompted the Fed to raise interest rates 6 times thus far in 2022, effectively stifling demand for Boston real estate.

The market for multi-family was not immune to this trend. Median sale prices for Boston multi-family properties have leveled off over the last 5 months after seeing record growth throughout the previous 10 years.

For the first time since the last housing crisis, year-over-year median sale prices for multi-family properties hit negative margins in 3 of the past 6 months.

| Month | 30 Day Median Sale Price | 30 Day Median Sale Price YOY Change |

| Oct 2022 | $996,347 | 2.45% |

| Sep 2022 | $1,084,234 | -0.12% |

| Aug 2022 | $1,012,222 | -7.56% |

| Jul 2022 | $1,147,684 | 9.53% |

| Jun 2022 | $1,042,564 | -8.53% |

| May 2022 | $1,149,272 | 14.79% |

| Apr 2022 | $1,188,596 | 14.41% |

| Mar 2022 | $1,008,796 | 8.64% |

| Feb 2022 | $998,071 | 12.01% |

| Jan 2022 | $1,122,909 | 22.20% |

| Dec 2021 | $1,099,016 | 19.96% |

| Nov 2021 | $1,079,788 | 22.03% |

| Oct 2021 | $972,566 | 4.78% |

Over the same 6 month period, the Fed announced 3 rate hikes of 75 basis points in June, July & September. Median sale prices fell in June, August, and September by -8.53%, -7.56%, and -0.12% respectively. When you consider that the Fed raised rates again this month and likely one more time before the end of 2023, you can predict that demand for multi-family homes for sale in Boston will fall further alongside median sale prices.

The next year may present opportunities for the savvy Boston multi-family investors who can take advantage of a down market. With the current apartment shortage, rent prices for Boston apartments have continued to rise throughout 2022 in spite of inflation and the looming recession. As Boston continues to evolve into a white-collar bio-tech hub, housing demand will continue to outpace the supply of rental units in the city, putting upward pressure on rent prices. While short-term economic outlook looks uncertain, the long-term prospects look strong for Boston’s overall economy.

For this reason, look for year-over-year multi-family median sale prices to fall by 5-10% in November and December. That figure will likely decline by double digits throughout the first quarter of 2023. If CPI does not come down to earth during the first half of 2023, we could see prices continue to fall throughout 2023. If inflation subsides and the Fed softens the interest rate, we could see the Boston multi-family market begin to trend back upwards during the latter half of 2023.